What is a bank of america number? Bank of America routing numbers are nine-digit codes used to identify the financial institution and the branch where an account is held. They are essential for processing electronic payments, such as direct deposits, wire transfers, and ACH payments.

Each Bank of America branch has its own unique routing number, which can be found on checks, deposit slips, and online banking statements. The first two digits of the routing number identify the Federal Reserve district in which the branch is located, and the next two digits identify the specific branch.

Bank of America routing numbers are important because they ensure that electronic payments are processed correctly and efficiently. Without the correct routing number, a payment may be delayed or even lost.

Bank of America Routing Numbers

Bank of America routing numbers play a vital role in the smooth functioning of electronic payments, enabling funds to be securely transferred between financial institutions. These unique nine-digit codes identify the specific branch where an account is held and facilitate efficient processing of direct deposits, wire transfers, and ACH payments.

- Identification: Routing numbers uniquely identify Bank of America branches for electronic payments.

- Routing: They direct payments to the correct financial institution and branch.

- Security: Routing numbers enhance the security of electronic payments by ensuring funds are transferred to the intended recipient.

- Efficiency: By using the correct routing number, payments are processed quickly and accurately, avoiding delays or errors.

- Convenience: Routing numbers simplify the process of sending and receiving electronic payments, making it easier for customers to manage their finances.

- Accuracy: Using the correct routing number is crucial to ensure that payments are credited to the correct account.

In conclusion, Bank of America routing numbers are essential for the efficient and secure processing of electronic payments. They serve as unique identifiers for branches, enabling funds to be transferred accurately and promptly. Understanding the importance of routing numbers and using them correctly is vital for seamless financial transactions.

Identification

Bank of America routing numbers serve as unique identifiers for branches, playing a crucial role in the processing of electronic payments. These nine-digit codes facilitate the accurate and efficient transfer of funds between financial institutions.

- Branch Identification: Routing numbers enable the identification of the specific Bank of America branch where an account is held. This ensures that electronic payments are directed to the correct destination, preventing delays or errors.

- Electronic Fund Transfers: Routing numbers are essential for processing various types of electronic fund transfers, including direct deposits, wire transfers, and ACH payments. By using the correct routing number, funds can be securely transferred between different bank accounts.

- Faster Processing: Accurate routing numbers accelerate the processing of electronic payments, ensuring that funds are credited to the intended account promptly. This reduces delays and minimizes the risk of payment disruptions.

- Security and Fraud Prevention: Routing numbers contribute to the security of electronic payments by verifying the authenticity of the financial institution and branch involved in the transaction. This helps prevent fraud and unauthorized access to funds.

In summary, the unique identification provided by Bank of America routing numbers is crucial for the smooth functioning of electronic payments. They ensure accurate and timely transfers of funds, enhance security, and streamline the overall payment process.

Routing

Bank of America routing numbers play a crucial role in directing electronic payments to the correct financial institution and branch. Without the accurate routing number, payments may be delayed, misdirected, or even lost.

For instance, when an individual initiates a wire transfer from their Bank of America account to an account at another financial institution, the routing number ensures that the funds are sent to the intended destination. The routing number identifies the specific branch where the recipient's account is held, facilitating the smooth transfer of funds.

Moreover, routing numbers are vital for processing direct deposits from employers or government agencies. The routing number provided by Bank of America ensures that employees' salaries or government benefits are deposited directly into their accounts, eliminating the need for physical checks or manual deposits.

In summary, the routing function of Bank of America numbers is essential for the efficient and accurate transfer of funds. It ensures that payments are directed to the correct financial institution and branch, enabling seamless electronic payments and direct deposits.

Security

Bank of America routing numbers play a crucial role in enhancing the security of electronic payments, ensuring that funds are transferred to the intended recipient and minimizing the risk of fraud or unauthorized access.

When an electronic payment is initiated, the routing number helps verify the authenticity of the financial institution and branch involved in the transaction. This helps prevent fraudsters from intercepting or diverting payments to unauthorized accounts.

For example, in the case of wire transfers, the routing number ensures that the funds are sent to the correct bank and branch, preventing fraudsters from redirecting the funds to their own accounts. Similarly, for direct deposits, the routing number helps ensure that employees' salaries or government benefits are deposited directly into their accounts, reducing the risk of theft or loss.

In summary, Bank of America routing numbers are an essential security feature for electronic payments, helping to protect customers from fraud and unauthorized access to their funds.

Efficiency

Bank of America routing numbers are crucial for ensuring the efficiency of electronic payments, enabling funds to be transferred quickly and accurately without delays or errors.

- Rapid Processing: By using the correct routing number, electronic payments are processed swiftly, minimizing delays in the transfer of funds. This ensures that payments are credited to the intended account promptly, reducing the risk of financial disruptions or late fees.

- Accuracy and Reliability: Accurate routing numbers guarantee that payments are directed to the correct financial institution and branch, eliminating the possibility of misdirected or lost funds. This high level of accuracy reduces the need for manual intervention or corrections, streamlining the payment process.

- Reduced Errors: Using the correct routing number significantly reduces the occurrence of errors during electronic payments. This minimizes the risk of incorrect account crediting, failed transactions, or rejected payments, enhancing the overall efficiency of the payment process.

- Improved Cash Flow: Efficient processing of payments using the correct routing number ensures that businesses and individuals have timely access to funds, improving cash flow and financial planning. This eliminates delays in receiving payments, preventing disruptions in business operations or personal finances.

In conclusion, Bank of America routing numbers play a vital role in enhancing the efficiency of electronic payments, ensuring prompt processing, accuracy, reduced errors, and improved cash flow. These factors contribute to the smooth functioning of financial transactions and the overall financial well-being of businesses and individuals.

Convenience

Bank of America routing numbers play a pivotal role in simplifying the process of sending and receiving electronic payments, offering convenience and ease of use to customers managing their finances.

- Seamless Transactions:

Routing numbers enable seamless electronic payments between Bank of America accounts and accounts at other financial institutions. This simplifies the process of sending and receiving funds, eliminating the need for physical checks or cash transactions.

- Time-Saving:

Electronic payments using routing numbers are processed efficiently, saving customers time and effort. Funds can be transferred quickly and securely without the need for lengthy paperwork or manual processing.

- Accessibility and Flexibility:

Routing numbers allow customers to make electronic payments from anywhere with internet access. This flexibility and accessibility make it convenient to manage finances remotely, regardless of location or time constraints.

- Reduced Costs:

Electronic payments using routing numbers are often more cost-effective than traditional methods such as wire transfers. This can result in significant savings for businesses and individuals who frequently make electronic payments.

In summary, Bank of America routing numbers enhance the convenience of managing finances by simplifying electronic payments, saving time and effort, providing accessibility and flexibility, and reducing costs. These factors contribute to the overall ease of use and efficiency of financial transactions for Bank of America customers.

Accuracy

In the context of Bank of America routing numbers, accuracy is of paramount importance to ensure that electronic payments are processed correctly and efficiently. The routing number serves as a unique identifier for the financial institution and branch where an account is held, directing payments to the intended destination.

Using the correct Bank of America routing number is essential to avoid errors or delays in payment processing. For instance, if an incorrect routing number is provided during a wire transfer, the funds may be sent to the wrong account or even lost. This can result in financial losses, inconvenience, and the need for manual intervention to rectify the error.

To ensure accuracy, it is crucial to obtain the correct routing number directly from Bank of America or from a trusted source, such as a bank statement or the Bank of America website. Verifying the routing number before initiating any electronic payments can help prevent errors and ensure that funds are credited to the intended account promptly and securely.

Frequently Asked Questions about Bank of America Routing Numbers

This section provides answers to common questions and concerns regarding Bank of America routing numbers, ensuring a comprehensive understanding of their importance and usage.

Question 1: What is the purpose of a Bank of America routing number?

Answer: A Bank of America routing number is a unique nine-digit code that identifies the specific branch where an account is held. It plays a crucial role in facilitating electronic payments by directing funds to the correct financial institution and branch, ensuring accurate and timely processing.

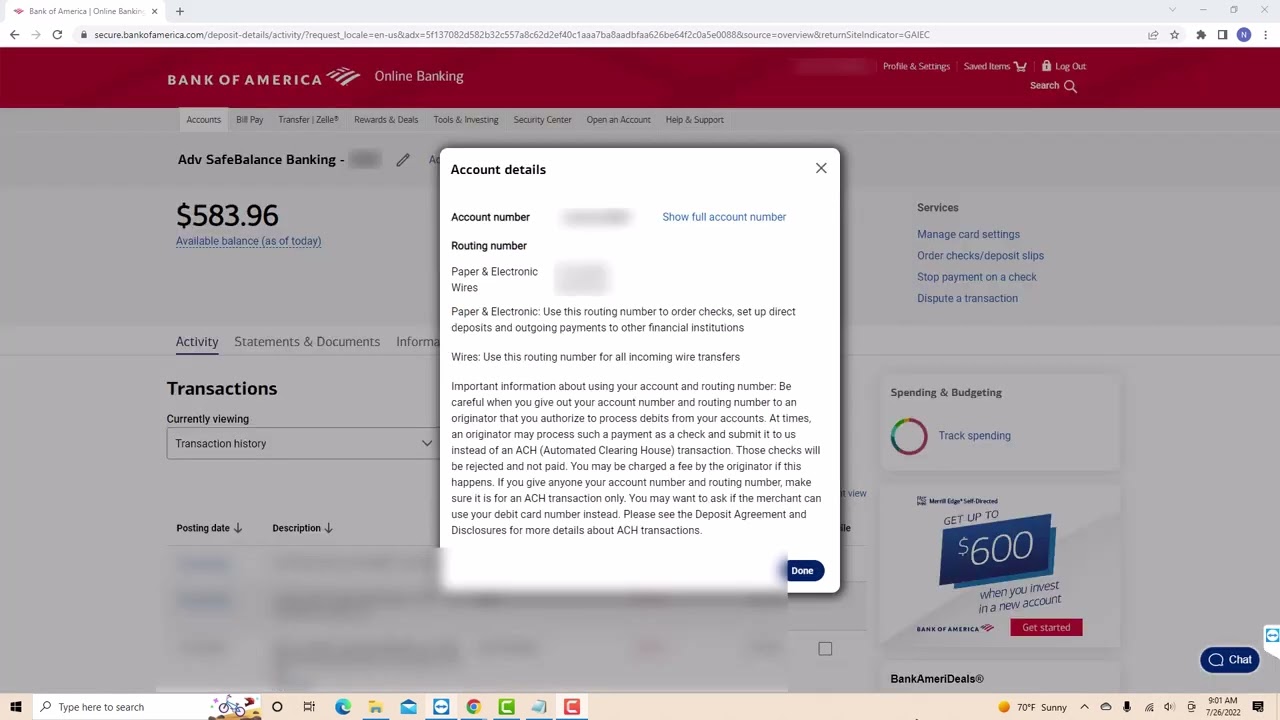

Question 2: Where can I find my Bank of America routing number?

Answer: Your Bank of America routing number can be found on checks, deposit slips, and online banking statements. It is important to use the routing number associated with the specific branch where your account is held to ensure the accuracy and efficiency of electronic payments.

Summary of key takeaways:

- Bank of America routing numbers are essential for processing electronic payments.

- Using the correct routing number ensures that funds are directed to the intended account.

- Routing numbers can be easily obtained from checks, deposit slips, or online banking statements.

Understanding and correctly using Bank of America routing numbers is crucial for seamless and efficient electronic payments. By addressing common questions and concerns, this FAQ section provides valuable information to ensure accurate and timely financial transactions.

Conclusion on Bank of America Routing Numbers

In conclusion, Bank of America routing numbers play a vital role in the efficient and secure processing of electronic payments. These unique nine-digit codes serve as identifiers for specific branches, ensuring that funds are directed to the correct financial institution and account. By using accurate routing numbers, customers can enjoy seamless and timely electronic payments, enhancing their financial management and overall banking experience.

The importance of Bank of America routing numbers cannot be overstated. They are essential for facilitating direct deposits, wire transfers, and other electronic fund transfers, enabling individuals and businesses to manage their finances efficiently. Moreover, routing numbers contribute to the security of electronic payments, minimizing the risk of fraud and unauthorized access to funds.

You Might Also Like

Ivanka Trump's Daughter Arabella: A Look At Her Life And StyleKnow Everything About Kourtney Kardashian's Age

Explore The Majestic Red Rock Canyon State Park

Discover Calvary Chapel Chino Hills: Your Spiritual Oasis

Ogden's Leading Real Estate Agent: Erika Carr

Article Recommendations

- The Life And Career Of Susie Feldman A Detailed Look Into Her Journey

- Unveiling The World Of Mkvking A Comprehensive Guide

- The Enigmatic World Of The Plumpy Mage A Deep Dive Into Mystical Realms